Proprietorship

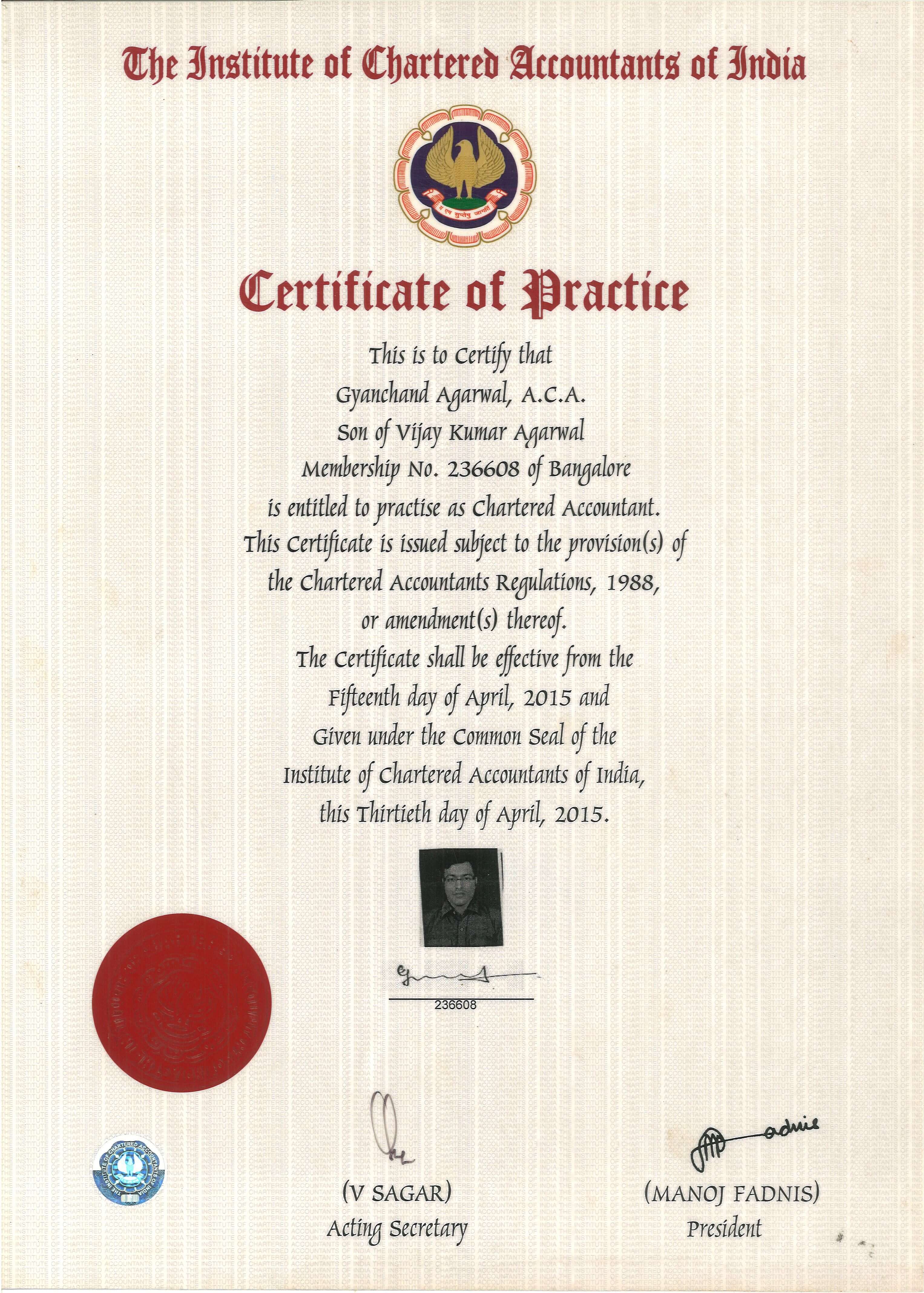

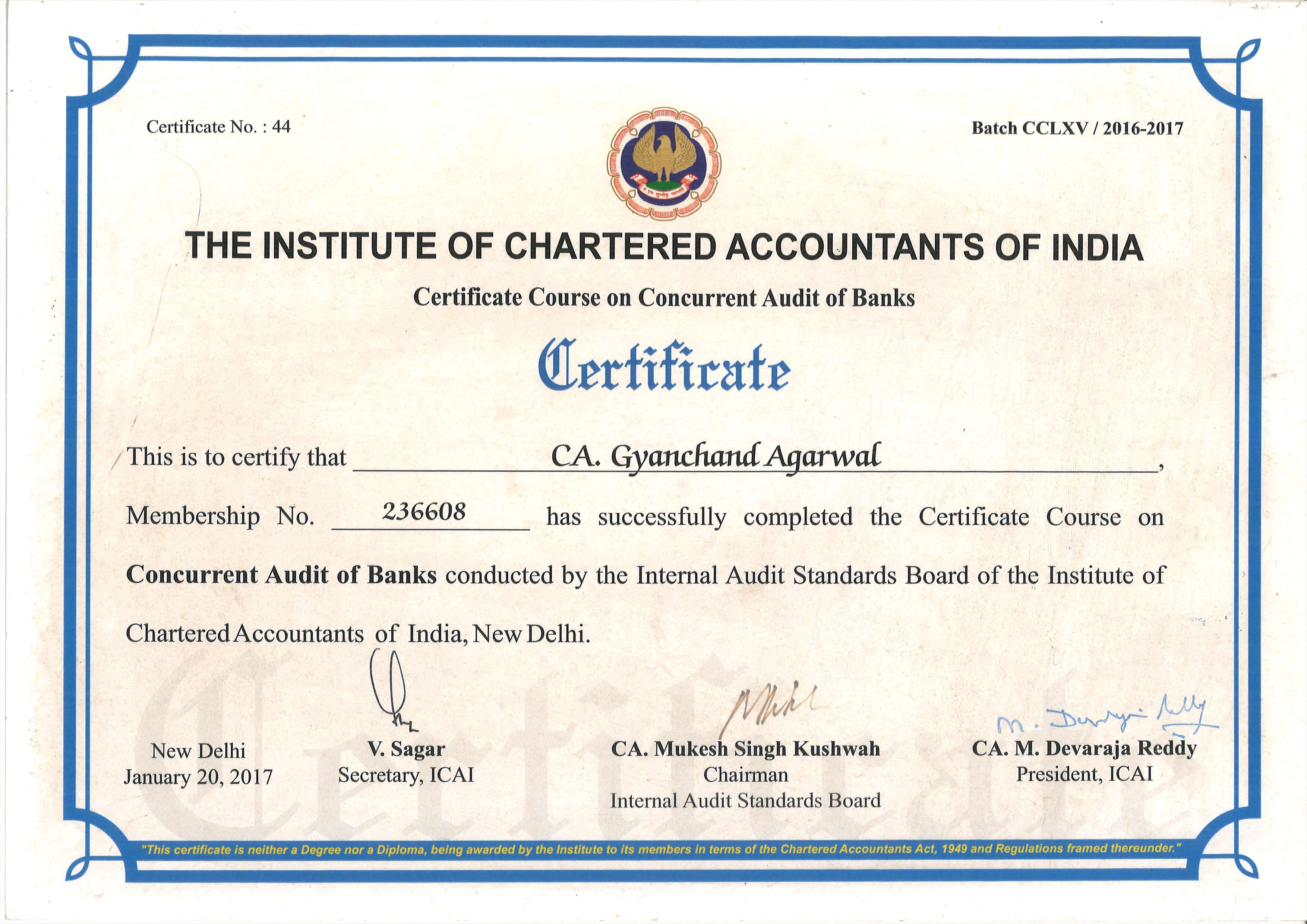

KAPG & Associates

A Proprietorship, also known as a Sole Proprietorship, is a business structure where a single individual owns, manages, and is responsible for the business. It’s one of the simplest and most common business forms, especially for small businesses and solo entrepreneurs. Proprietorships are best suited for individuals or small businesses with low risk and low capital requirements. They offer simplicity and direct control but come with the downside of personal liability and limited growth potential. Here are the key characteristics:

Single Ownership: A proprietorship is owned and managed by one person who has complete control over the business operations, decision-making, and profits.

Unlimited Liability: Unlike corporations or limited companies, the owner has unlimited liability. This means the owner's personal assets can be used to cover any business debts or liabilities if the business cannot meet its obligations.

No Separate Legal Entity: Legally, the owner and the business are considered the same entity. The business does not have a separate legal identity, and the owner is personally responsible for all aspects of the business.

Minimal Compliance Requirements: Proprietorships have fewer compliance obligations, such as simpler tax filings and minimal regulatory requirements, making it easier and cheaper to establish and maintain than other business structures.

Direct Control and Flexibility: The owner has complete control over decision-making and operations, offering significant flexibility. This allows for quick decisions and direct handling of all aspects of the business.

Income Tax on Personal Return: The profits of the proprietorship are reported on the owner's personal income tax return, making tax filing simpler, but this also means that business income is taxed at the owner's individual rate.

Limited Lifespan: A proprietorship doesn’t have perpetual succession, meaning the business ceases to exist if the owner dies, retires, or decides to close the business.

Limited Access to Capital: Raising funds can be challenging for proprietorships, as they don’t issue shares, and lenders may see them as riskier due to the lack of limited liability. Typically, funding comes from personal savings, loans, or investments from friends and family.